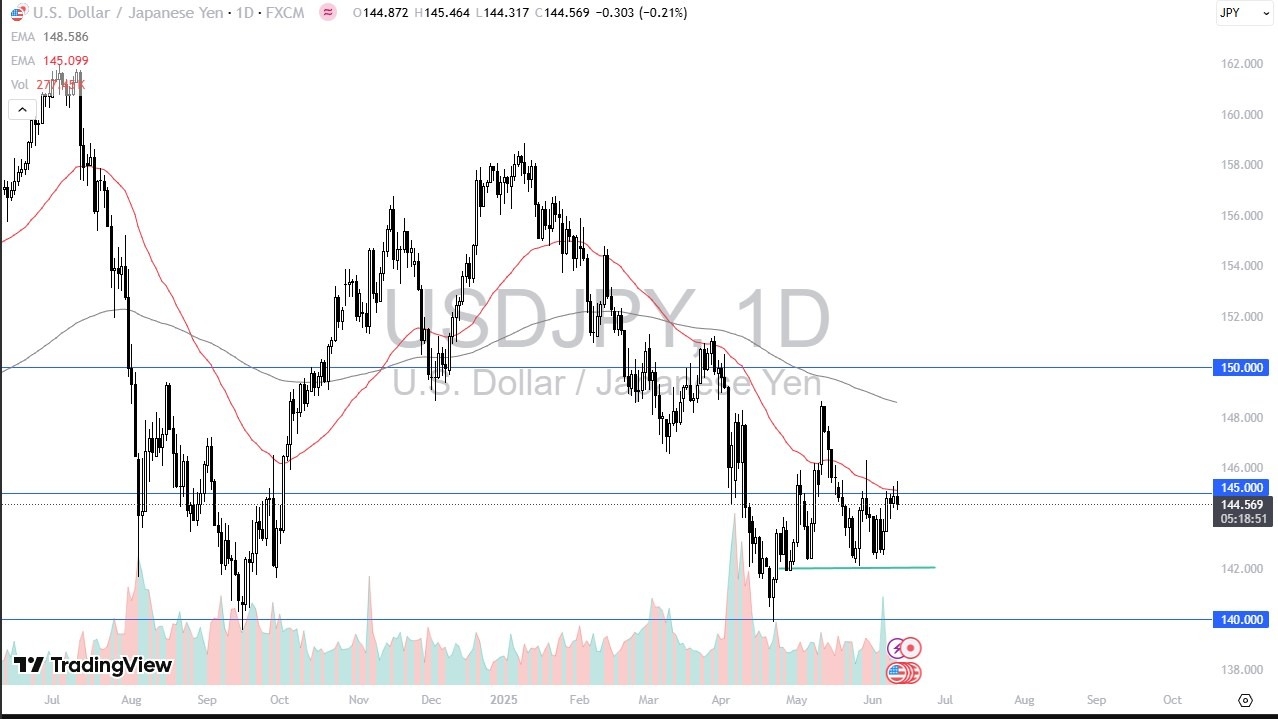

- The US dollar initially rallied during Wednesday’s trading session, but the 145 yen level continues to act as a strong resistance.

- This level has held firm, and it’s widely seen as a critical threshold.

- Adding to the challenge is the 50-day EMA hovering just above, which could further hinder upward momentum.

Nonetheless, I think this is a market where the interest rate differential will continue to favor the US dollar. And despite the fact that CPI was a little bit cooler than anticipated in America, I still think we have to pay close attention to the whole idea of the trade situation between the United States and China having a major influence on risk appetite as well. After all, the Japanese yen is considered to be the ultimate safety currency, if you will.

Pullbacks Could Be Interesting

So, we’ll have to see how that plays out. With that being said, I think you have a scenario where a pullback almost certainly gets bought into just as a breakout almost certainly will get bought into. I don’t really have any interest in trying to short this market right now as the 142 yen level has been important multiple times.

I think that your floor breaking down below there opens up the possibility of a drop down to the 140 yen level, which has even more ramifications from a support standpoint. All things being equal, this is a market that I am positive on, but I recognize you’re going to have to sit around and just get paid to swap and be very patient between now and the move that we do end up having. A lot of patience here goes a long way.

Want to trade our USD/JPY forex analysis and predictions? Here’s a list of forex brokers in Japan to check out.

Christopher Lewis has been trading Forex and has over 20 years experience in financial markets. Chris has been a regular contributor to Daily Forex since the early days of the site. He writes about Forex for several online publications, including FX Empire, Investing.com, and his own site, aptly named The Trader Guy. Chris favours technical analysis methods to identify his trades and likes to trade equity indices and commodities as well as Forex. He favours a longer-term trading style, and his trades often last for days or weeks.